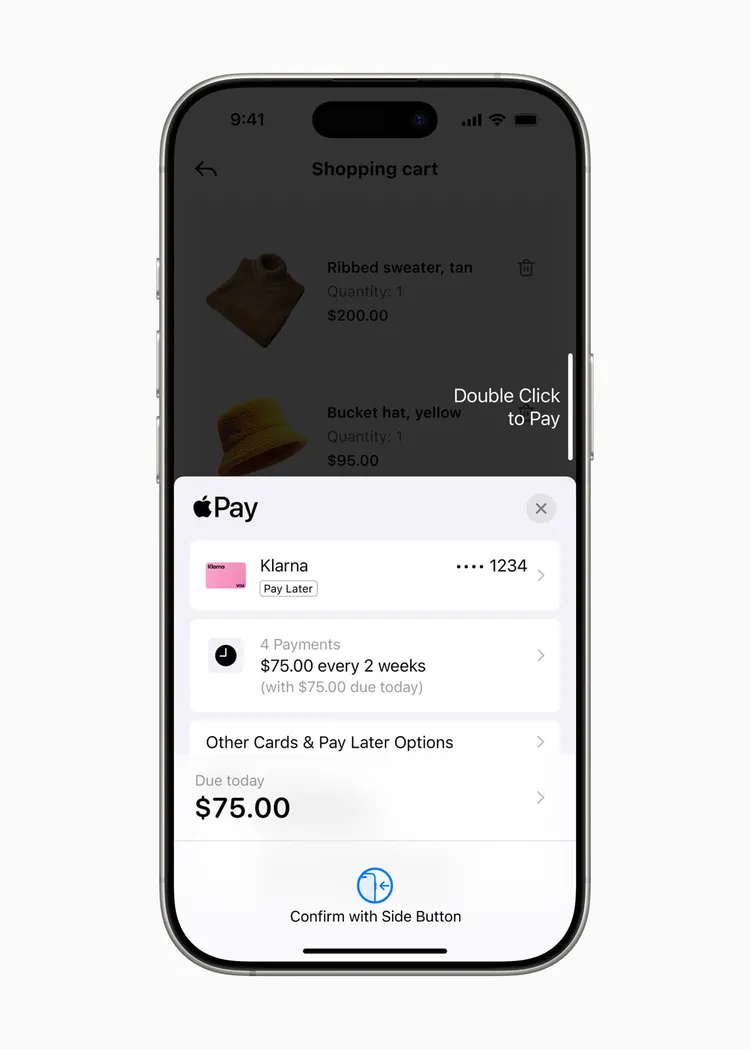

Imagine a checkout experience that’s as flexible as it is secure—one that lets you pay in installments while leveraging the simplicity of Apple Pay.

That’s exactly what’s now possible as Klarna, the popular “Buy Now, Pay Later” (BNPL) provider, integrates its payment options into Apple Pay. This collaboration allows consumers in the U.S. and U.K. to choose Klarna’s flexible payment plans at Apple Pay checkout, both online and in-app.

Let’s dive into how this innovation will benefit shoppers and reshape digital payments.

What Klarna’s Integration with Apple Pay Means for Shoppers

Apple Pay users now have the option to spread out payments with Klarna, making purchases more manageable. Whether it’s an in-app or online purchase, users can select Klarna’s interest-free installments or financing options with APRs as low as 0%. This integration caters to those who want flexibility without sacrificing the security and ease for which Apple Pay is known.

Key features include:

- Greater flexibility in how your store looks and functions.

- Seamless Process: Klarna’s options are directly in Apple Pay, so checkout is as easy as a few taps.

- Availability: Currently accessible in the U.S. and U.K. on iPhone and iPad devices with iOS 18 or iPadOS 18, Klarna plans to bring this service to Canada soon.

How This Integration Enhances Shopping Security and Convenience

Shoppers using Klarna through Apple Pay get the best of both worlds: secure transactions from Apple and the payment flexibility Klarna provides. Apple Pay is known for its robust security, offering tokenized transactions that protect users’ information. This added layer of protection is especially appealing for users who want to enjoy the benefits of BNPL without risking their financial data.

For consumers, this means:

- A Faster Checkout Experience: Klarna’s integration in Apple Pay removes the need to enter card information or personal details manually.

- Improved Financial Control: By allowing payments in installments, Klarna gives users control over their spending while keeping up with secure Apple Pay transactions.

The Bigger Picture: Market Impact of Klarna’s Move

As the BNPL market grows, Klarna’s integration with Apple Pay puts both companies at the forefront of digital payments. Klarna competes with other BNPL services, but Apple’s backing strengthens its reach significantly. This partnership also puts pressure on competitors to expand their own services to keep up with the convenience and flexibility Klarna now offers Apple Pay users.

According to industry experts, the BNPL model has already become popular, especially among younger consumers who prefer cash flow flexibility. Klarna’s collaboration with Apple may accelerate the adoption of BNPL as a standard option in mainstream payment platforms, setting a new industry standard.

Future of BNPL and Digital Payments

With Klarna’s expansion plans into Canada and potential partnerships on the horizon, BNPL is expected to become a common feature in digital wallets globally. Apple and Klarna’s alliance points to an emerging trend: digital wallets integrating diverse payment solutions to become “one-stop shops” for secure, flexible, and convenient transactions. This could change how people manage their finances, encouraging a shift toward digital-only payments in retail and e-commerce.

What can we expect next? Likely, more innovation in the BNPL space as companies find ways to integrate into mainstream digital payment solutions, giving users even greater options at checkout.

Final thought

Klarna’s integration with Apple Pay is a win for consumers, offering the flexibility of BNPL payments combined with the security and ease of Apple’s digital wallet. By merging these two powerhouse services, users can now take control of their finances with more options than ever before.

For shoppers, this is an opportunity to experience a new level of convenience. The future of payments is looking more flexible and user-centered, making this an exciting time for both Apple and Klarna customers.

November 12, 2024

November 12, 2024

TEAM id

jnext_services

email us [email protected]

india

+91 98587 63596

United Kingdom

+ 44 77679 57915